Can Google predict the Stock Market?

I’ve often wondered whether Google keyword traffic can be used as an indicator on the stock market. Specifically, do changes in Google searches for a particular company translate to an increase in buying interest in that stock which may lead to an increase in the stock price? Or to put it another way if Google traffic for a publically traded stock increases does that mean the share price will follow and go up also?

The idea is not entirely new, there have been some articles written about the impact of Google traffic on the stock market, however these have been largely in relation to general search terms. In this hub I will be examining whether Google search traffic has any correlation with the share price of speculative stocks. I am interested in speculative stocks, or emerging companies as I believe these will be most responsive to changes in Google traffic, and the search traffic will be primarily investment related.

Background

Google has a feature called “Google Insights for search” which graphs the google traffic trends for a particular search term dating back to 2004. The data is graphed on a normalised scale between 0 and 100 according to search traffic (0 being no traffic, 100 being the highest traffic volume over the period).

Over the next few weeks I will be conducting an experiment by looking at a sample of companies and measure their Google traffic trends vs. the share price. The sample will be taken from emerging companies from the Canadian venture exchange. The Canadian Venture exchange is a marketplace for emerging companies. My reasons for using companies listed on the Canadian Venture exchange twofold:

1) Emerging companies will not get the general traffic that larger companies get. For example Apple Inc will get a lot, if not most of its Google traffic from consumers who are searching for Apple products. The number of search queries for Apple Inc the stock (i.e. Investor interest) will be impossible to separate out from the general search traffic. Now compare that to say Google traffic for a company like Avalon Rare Metals for example ( a Canadian Emerging exploration company). I believe that Google searches for the words “Avalon Rare Metals” will be driven primarily by investor interest in the company. It is this Google traffic that I am trying to target.

2) Emerging companies are more likely to be driven by speculation than larger companies, and this will manifest itself in google search traffic. It is also more likely that Google traffic could be a leading indicator for emerging companies, rather than a lagging indicator for larger companies. If we think about companies like T-Mobile, Bank of America, and B.P for example....a lot of the Google traffic for these companies will be retrospective (lagging). For example Bank of America has been in the news a lot lately, it is highly likely (in my opinion) that changes in Google traffic for the search term “Bank of America” is a consequence of this news, not the other way around. This would mean that Google traffic is a lagging indicator, which is not what I am looking for, as lagging indicators have limited use for the investor. Google traffic is only going to be useful if it is a leading indicator (i.e. leads the share price). By targeting smaller companies I believe that the likelihood of Google traffic leading the share price is higher than for larger more prominent companies. I will try to explain this more clearly in the following paragraph.

Is Google Traffic a measure of investor sentiment?

I spend a lot of time reading about stocks on forums and blogs. Like a lot of stock market speculators (gamblers) I dream about hitting the jackpot and buying that stock that goes on to become a 20 bagger.

The one thing I commonly notice is that emerging stocks go through a phase where there is a lot of speculative interest and then often a big run up in the share price, which is normally driven by good news. At this time the stock is often one of the most popular stocks on the forums and for a few days/weeks it will attract a lot of interest, this condition is sometimes known as “speculative froth”. Unfortunately the reality is by this stage a stock becomes widely known, it is often too late and the big gains have already been made. A lot of people make the mistake of buying in at this point based on the strength of the past gains and performance. This can be a costly mistake, more likely than not there will be a retrace in the share price as the early investors take profits, or worse in the case of a bubble or “pump and dump” a big fall in the share price will ensue and they will lose a lot of money.

The below graph is a good example of a speculative stock which experienced explosive gains between May 09 and April 2010 where the share price went from 2c to 97c! It goes without saying that as an investor you want to know about (and buy) this stock when it is somewhere between 2c and say 70c, not when it gets to 97c.....but can Google traffic help us to identify the stock before it peaks??

Let’s take a look at a few examples

Before I started writing this article, I did not want to waste my time completely by spending hours on a concept that had zero chance of working out, so I took a look at a few stocks to test the hypothesis.

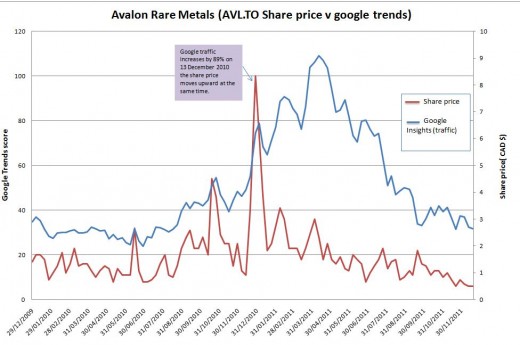

Let’s take a look firstly at Avalon Rare Metals (ticker AVL.to). Avalon Rare Metals is a Canadian rare earths explorer. The chart graphs the share price vs google insights score for the 2 year period December 26, 2009 to December 26, 2011.

What can we conclude from the chart?

- Google traffic loosely follows the share price.

- The largest spike in Google traffic coincides with the largest increase in the share price. Between November 15, 2011 and April 11, 2011 the share price increased by $5.83 or 180%. Between December 13, 2011 and December 29, 2011 Google traffic increased by 89%.

- Google traffic spiked at the same time or slightly after the share price began to rise steeply. It appears that the Google traffic is reacting to the gains in the share price rather than the other way around. It suggests that Google traffic is not a leading indicator but a lagging indicator. Not what I wanted to see!!

- The share price kept rising after Google traffic hit its peak on December 29, 2011.

OK let’s take a look at another company Revett Minerals, a Canadian Silver explorer/Emerging Producer.

This is more interesting because the graph clearly shows that Google traffic spikes before the share price increases, in fact it happened twice. Once on October 2010 and then again in March 11 where a spike in Google traffic precedes an increase in share price. It is not conclusive by any means but it is encouraging.

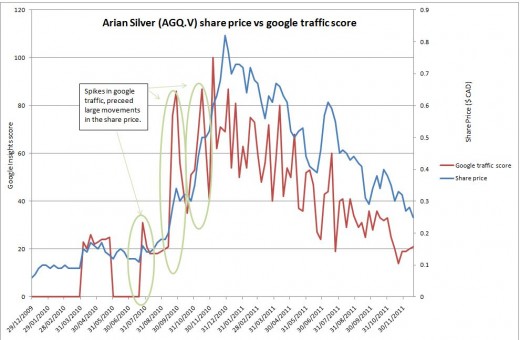

Let’s take a look at another company, Arian Silver, another Canadian Silver explorer/Emerging producer

This is another interesting chart as spikes in Google traffic appear to happen before movement in the share price. If we look at the raw data on September 7, 2010 Google insights score was 20 (out of 100) on October 2, 2010 the Google insights score had spiked to 86. The Google insights score peaked at 100 on December 6, 2010. The share price peaked at 83c on December 29, 2010. This is a good example where the google search traffic is spiking BEFORE corresponding movements in the share price. The trend is less clear from 2011 onward.

Summary

This hub sets out in general terms idea that google traffic can be used as an indicator to make decisions on buying/selling speculative stocks. At this stage I have no idea whether there is anything to suggest this is true or not, other than looking at a few examples. In the coming weeks I will be testing this concept against companies on the Canadian Venture exchange. The objective is to find out if:

a) there is a consistent correlation between Google traffic and the share price of the companies selected;

b) the Google traffic is a leading indicator to movements in the share price.

Results will be published in future hubs over the coming weeks/months. The next Hub I write on this subject will set out the experiment in detail and cover sample selection and how the results will be evaluated. Thanks for reading.